Flying Ace

M&A ADVISOR

HOW MIGHT I HIRE THE RIGHT DEAL TEAM FOR MY SALE?

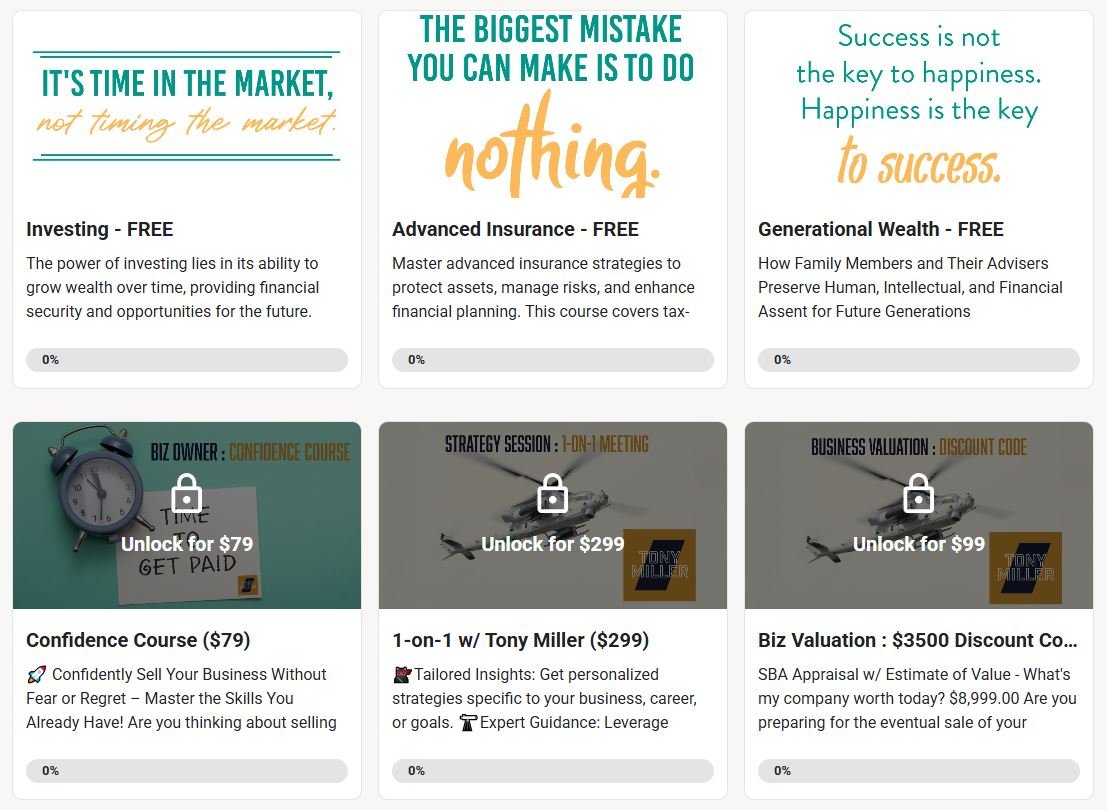

Tony Miller is a M&A Advisor at BizEx, a Business Sales, Mergers & Acquisitions firm specializing in the sale of $1mm to $50mm+ businesses.

Tony brings a supportive team of senior advisors, lenders and escrow professionals to every sales transaction. Tony is an active member of the International Business Brokers Association (IBBA), California Association of Business Brokers (CABB), Ohio Business Broker’s Associations (OBBA), a graduate of Pepperdine University’s Graziadio School of Business with a MBA in Entrepreneurship and held the rank of Sergeant in the United States Marine Corps.

How do you determine the value of my company?

Your gut might tell you first to examine financial performance or analyze the competitive landscape.

In a study of 1,511 companies, we found one factor commonly omitted when assessing the value of a company – the owner. Our research suggests that the owner's reasons for exit and the steps they take to prepare can play a significant role in the value of a company.

Initial Interview (meeting the team)

We’re looking forward to it!

Identify goals and objectives

Go over the business sales process

Dig deep into your company so we can properly value your business.

Valuing your business

Our valuation goes beyond the simple multiple of earnings method.

Increase your score on each of the eight drivers of company value.

Find strategic buyers for your business.

Structure your business to maximize its value.

Accelerate the pace of positive word-of-mouth for your business.

Boost your company’s cash flow in the same way Harley Davidson finances its business.

Differentiate your business using the same methodology Warren Buffet looks for in the companies he invests in.

Minimize your company’s reliance on your personal involvement using some of the strategies Tim Ferriss used to reduce the time he spent in this business to just four hours a week.

Is now the right time to sell?

Confidently Sell Your Business Without Fear or Regret – Master the Skills You Already Have!

Are you thinking about selling your business but feel overwhelmed by the process? Worried about your future, your employees, or whether you’ll get the deal you deserve?

The truth is, you already have everything you need to sell your business successfully. You’ve built, led, and grown your company—and those same skills will help you overcome any fear and turn this exit into your biggest success yet.

Creating the Marketing Package

Our Confidential Business Review (CBR) is the roadmap for how we take the business to market

It’s a story of value drivers, risk factors and growth

It provides a serious buyer all of the information they need to make a preliminary decision to move forward

Time to hit the launch button

We spend thousands of dollars per year marketing to external sites to generate buyer interest

We have 15,000+ buyers in our proprietary database alone!

When we launch a listing, everyone in that database who is searching for your type of business will get a teaser

We take the time to search for private equity and strategic buyers for your business

Negotiating the Deal

The two key deal terms are price and risk. The more risk assumed a buyer will demand a more favorable price

If the buyer is a good fit, we’ll get the terms ironed out

If the buyer is not a good fit, the deal will likely fall out

Matching the right buyer with the right business is how we define success

Due Diligence

If you have all of your books and records in order, this process can go fairly quickly

If not, the process can drag out months and ultimately not be consummated

Third party lenders will also need to perform their own due diligence on both the buyer and the business

Drafting the Contract

Good transactions attorneys keep the negotiations moving forward efficiently

They customize contracts to limit vagueness and ambiguity

This investment can be thought of as an insurance to reduce risk of litigation post-closing

Closing

At the close, the business assets are transferred and the down payment will be wired to your account

Post-closing, there will be a transition period, training, possible consulting and then a release of any hold backs for tax liens or indemnifications

Celebrate! Celebrate! Dance to the music!